Teens and smart spending don’t always go together, but having a nearly 14 year old in my house means I’m learning fast. One of the most important aspects of teaching your teen smart spending habits is allowing them some freedom while monitoring their spending and saving habits. It’s during these key years that your kids will go from have the ‘I wants’ to managing allowance and/or earnings to paying their own bills in what seems like the blink of an eye. (and let’s not talk about them going off to college or the ‘real world’ ok?)

photo credit: Randy Pertiet

During the teen years they will make mistakes which will turn into teachable moments, and create lasting habits that will see them into adulthood. Teens spend billions (yes, billions) of dollars in the US. Since they rarely have regular bills most of this money is spent (not saved) on entertainment, transportation, and personal wants (anything from makeup and clothes to sports equipment or and car parts).

Translating Elementary Tactics to Teens

Our tactic with younger kids works well. They all contribute to the family savings jar, their own short-term savings, and spending goals. We opt to give them an allowance and they earn extra money for extra chores funding their goals and spending.

Translating that to our oldest has been challenging. His wants are more expensive now, and he has less time to do extra chores. It’s also been harder to keep track of his spending. When he was younger I would often ‘hold’ his money for him and go with him to purchase something, but now he is able and willing to purchase things on his own.

Enter the Bill My Parents card. I shared previously, how it works to setup an account and what conversations that started for us. Now that we’ve had some time to use the card, I’ll share my thoughts on how it works for parents. (My final post will share my teen’s thoughts on the card)

Track You Teen’s Spending

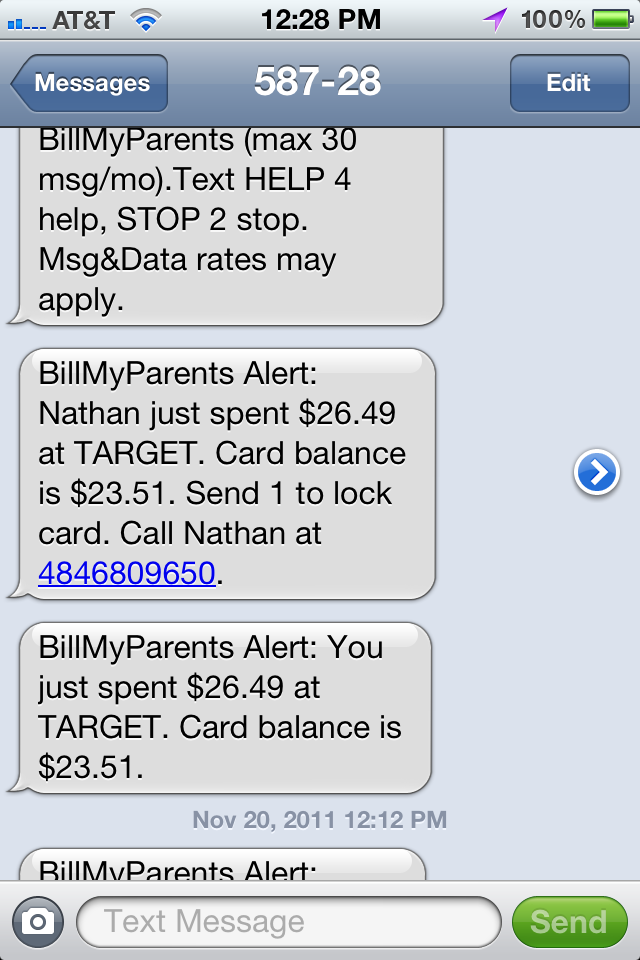

When setting up your teen’s Bill My Parents card (and later in your account settings) you are offered the option of being notified about your teen’s spending via text or email. I choose to be notified via text message when Nathan spent money.

No, that's not his phone number. ![]()

Texts of my teen’s spending was handy for several reasons:

- No matter where I am I could receive texts about my teen’s spending.

- I could easily lock the account no matter where I was if needed. All I needed to do was send “1″ in response to the text message.

- Nathan’s phone number was included in the text so I could contact him immediately if need be.

- The text includes the amount he spent, where he spent his money, and what is left of his balance. Handy if he was traveling and I knew he’d be short on funds, as well as telling me where he is.

Maybe it seems a little ‘big brother’ to some, but to me it makes those mistakes easier to spot before we go down the road of overdrafting an account, maxing out a credit card, or racking up student loan debt.

Knowing that I was tracking spending also helped my teen understand how I would be slowly giving him more financial responsibility over time. It also opened up a conversation about making financial mistakes and what we can learn from our mistakes.

What do you think of pre-paid cards? Would you use one with your teen? What do you think of the text or email option for parents?

Kelly

Disclosure: This post is part of a series being sponsored by BillMyParents on theCentsibleLife.com. For more info or to signup for a Bill My Parents card visit www.billmyparents.com.

© 2011, Whalen Media LLC. All rights reserved. To repost or publish, please email Kelly.