We’re on vacation at my parent’s house this week. They live on the water, which is a fun place to be with the kids, but the house is far enough from the hustle and bustle that I can enjoy the quiet atmosphere. It doesn’t hurt that their house is fully equipped with everything we need, so all we need to bring are some clothes and ourselves.

I’m going to limit my blog posts this week so I can enjoy time with the kids, and regroup a bit. I am focusing on a few other projects that are brewing, which you will hear more about soon.

In the meantime, I have to confess my splurging sins.

We budgeted for the trip we came back from, with a little extra in case we needed it, and we spent every penny of the budget. I don’t regret it for a second, and enjoyed myself immensely while we were away. It felt really good to take a break from the constant grind of childcare, housework, work, pet care, and the bazillion other thigns we do every day. It was also amazing to have such a big change of scenery. I totally got bit by the travel bug though, and I’m already planning our next (kid included) trip and thinking of plans for our 10 year anniversary in a year and a half.

Part of the expenses included some much needed items for me; a laptop bag, a dress for going out to dinner (I didn’t have one that was appropriate), and some shoes to help my aching feet (next time I’ll get them ahead of time, breaking them in while we walked a ton caused a minor foot injury). Of course buying in San Francisco was fun, but more expensive than I realized with the sales tax of 9.5%!

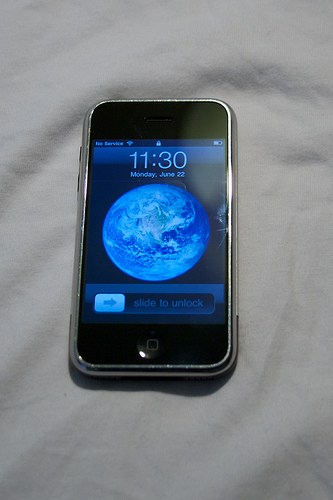

When we returned home, we talked about getting iPhones for the hubby and myself. I can justify it a million ways, but it is NOT a necessity. Though, apparently it will make me younger, more well-off, and more productive. The iPhones have proven to be extraordinarily helpful, and while they will cut into our monthly budget, they will not effect our debt repayment, so it’s a splurge we can afford to make. I’ve only had it a few days and it’s already helped me stay in touch better with family and friends, kept from getting lost (twice), and I’m using it to help me keep track of everything from my grocery list to my fitness goals.

We’re on hiatus from debt repayment for the next month (or two) so we can grow our emergency fund, again. It is tough to slow down, since I want to be debt-free TODAY, but I have to realize that this time we are committed and it will take time. There is no quick solution to paying off debt, it’s just a slow and steady race.

Sometimes a break, or an affordable splurge is worth it, since it motivates you to be more focused. I hope that’s the case since we’re gearing up for our 3rd No Spend Month starting this Thursday. Maybe you’ll join me? If you budget monthly start on July 1st, along with Rachel from Small Notebook. It’s good motivation.

Kelly

[…] From splurging to not spending - by Kelly @ The Centsible Life […]